$37,100,000,000. That’s how much American families spent on back-to-school supplies for their kids in K-12 last year, according to a study by the National Retail Federation. On average, that’s close to $848.90 per household.

If the thought of that blow to your wallet has you wincing, you’re not alone. No matter how savvy the shopper, it’s hard to navigate the onslaught of back-to-school deals and crowded store aisles. But a few quick tips can help you reduce the impact on your finances and educate your kids about good saving habits.

1. Allocate what you have.

There’s no better price than free. At the end of each school year, go through your kids’ supplies and see what can be reused. Would a quick wash perk up that backpack? Can you sharpen last year’s colored pencils or remove the first few pages of that notebook? Hand-me-downs are also a great solution if your kids are close in age.

Activity: Refreshing used supplies can be a fun arts-and-crafts activity for the family. Crafts like paper bag book covers or washi-tape pencils make it easy to personalize on the cheap.

2. Budget in advance.

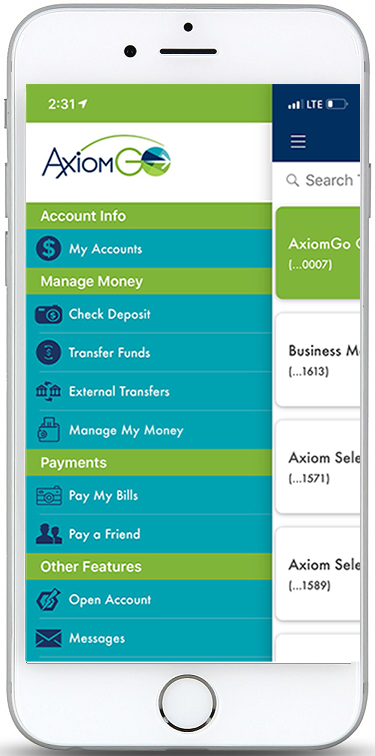

A budget is a safety net. It protects you from impulse buys and overpriced goods, so you’ll never spend beyond your means – and you’ll always have enough for the things that really matter. Not sure how to get started? Download the AxiomGO app and use the built-in My $ Manager tool to get an instant snapshot of your finances. Plus, the app will send you automatic notifications if you’re at risk of going over your budget, so you can shop with confidence.

Activity: Often, kids aren’t aware of routine expenses like utilities or insurance payments. Sit down with a pen and paper and work together to draw a map of your household income and expenses. AxiomGO’s My $ Manager can help: It allows you to see all your transactions in one place, without having to sift through different accounts.

3. Compare prices.

3. Compare prices.

Back-to-school season means big sales for retailers, and they’ll do their best to improve margins wherever possible. Often their advertised ‘deals’ won’t give you the best price, so read coupons carefully. Check online, too—but know that web retailers may sneak in a price hike. Lastly, don’t forget about thrift shops and secondhand stores. You can find lightly used clothing, backpacks, and supplies at a steep discount from big box retailers.

Activity: Get your kids involved with a scavenger hunt for the items on your shopping list, with a small reward for whoever can uncover the best deals.

4. Don’t buy for appearances.

As enticing as that sequined unicorn folder is, a plain one will likely do just as well. It will also have a longer lifespan as your kids’ interests change over time. Instead, encourage them to save their allowance in advance if they have their hearts set on a special purchase.

Activity: Talk to your kids about the difference between needs and wants. Encourage them to identify which school supplies are necessary and which ones they could do without. Then, write down a wish list and prioritize the items.

Back-to-school season is a time when kids are more aware of household spending, so take the chance to explain why and how your family saves money. In addition to getting the best deal for your family, you’ll be sharing valuable financial lessons that will last a lifetime.

Axiom Bank N.A., a nationally chartered community bank headquartered in Central Florida, provides retail banking services, including checking, deposit, and money market accounts. It also offers commercial banking services, treasury management services and commercial loans for real estate and business purposes.