It’s late September and that can only mean one thing. It won’t be long until you hear the first faint strains of Christmas music at the mall. One moment you are browsing the summer sale racks and the next you find yourself subconsciously singing along to “It’s beginning to look a lot like Christmas.” The bright side of Christmas encroaching on September is that you have time to plan so you can avoid (or at least minimize) the credit card bills that arrive after Christmas.

Here are three tips to help avoid overspending over the holidays. While none of these tips are original or earthshaking, they work!

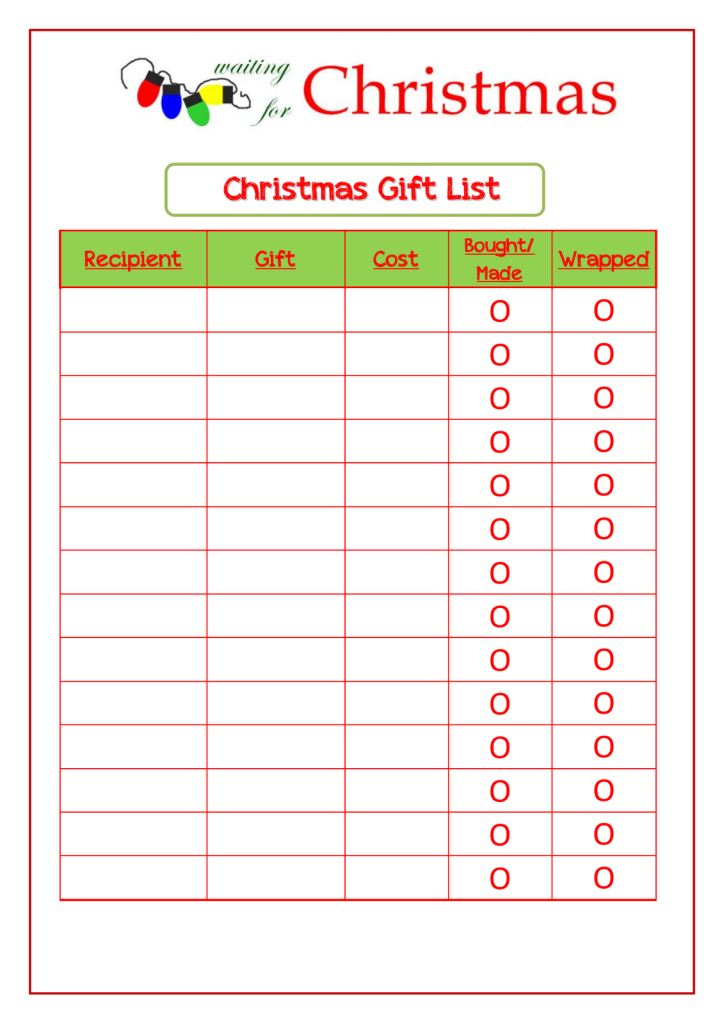

Make Your Christmas Gift List

Buy Gifts Year Round

Systematically Put Aside Cash

Make Your Christmas Gift List

This works best if you make your list all-inclusive. My list includes my husband and children, extended family members and friends, teachers, sitters, and everyone we tip at Christmas. My list also includes other holiday expenses like decorations, cards, gift wrap, and postage for mailing cards and gifts.

This list serves three purposes. First, it becomes my holiday budget. I use it to set spending limits based on the total amount that we plan to spend on gifts. Second, it serves an on-going shopping list. As I purchase gifts, I add them to the list. Third, the list prevents me from duplicating gifts over the years. After Christmas, I add the year on the top, save the list, and make a new one for the next year. Besides serving as a “gift history” to makes sure we don’t give Aunt Imogene the same cookbook two years in a row, it’s a fun way to look back to see how quickly my children’s gifts have gone from Fisher Price to Apple products!

Buy Gifts Year Round

I don’t care that my family occasionally rolls their collective eyes at my year round Christmas shopping. A caveat however – it works best if you add your purchases to your gift list, and stash the gifts in a designated place. Otherwise, the perfect gift purchased in February will be long forgotten by December. Year round gift purchasing reduces holiday shopping stress and helps to spread the cost of Christmas giving over the year.

Systematically Put Aside Cash

Saving year round for Christmas is certainly not a novel idea. I remember my mother’s “Christmas Club” account at our neighborhood bank. Find a way to save that works for you. Knowing roughly what we’ve spent in previous years, I figure out an amount of cash that I can comfortably put aside weekly. I actually stash cash weekly in brown envelope, jotting down the date and the amount each time I add to the envelope. This method will only work if you can resist dipping into the envelope to pay the sitter or the pizza delivery guy. Each December I deposit the cash into our checking account to pay the January credit card bill.

There are certainly other and perhaps better ways to save than the giant envelope of cash. Make weekly or monthly transfers from checking to savings, open a savings account, save all your change in a jar, or be creative!

It’s not too late this year to try these tips to help take the stress out of Christmas shopping.